Peerless is pleased to announce their newly-launched investment fund which will focus on quality situations that warrant preferred equity investment.

FUND TERMS

Target Fund Size

$50 million - $100 million

Investment Period

18 months + (1) 6-month extension

Fund Term

5 years + (2) 1-year extensions

Preferred Return

8% Per Annum

Waterfall

8% preferred return; Return of Capital;

80/20 Investor Sponsor Split with GP catch-up

Fees

1% asset management fee on actively invested capital, and a 1% one-time capital fee

Capital Call Period

18-months

Capital Call Frequency

Quarterly

STRATEGY

Considering the current environment, the fund is positioning itself to exploit disruptions in both the debt and commercial real estate markets through their ability to scrutinize and test various investment scenarios, in excess of traditional investment manager capabilities. This stems from an expertise and breadth in both operating and developing institutional-grade assets, in core multifamily markets and major universities, across the nation.

The timing to enter this disrupted market by offering preferred equity to select sponsors requires immediate action through below mechanisms:

- Invest in developments, value-add repositions and stabilized core assets.

- Deploy capital over immediate 24-month period to exploit current market conditions and disjointed environment.

- Two-to-five-year investment horizons, depending on market conditions and situation.

- Up to 80% LTV with preferred structure, to be concurrent with senior debt positions.

Asset Classes

Multifamily and Student Housing

Target Portfolio:

10-15 investments, with no more than 20% of the fund concentrated in any one investment

Target Markets:

Major MSAs and universities nationwide

Minimum Target Allocation:

$2M

Max Target Allocation:

$10M

PREFERRED

EQUITY APPROACH

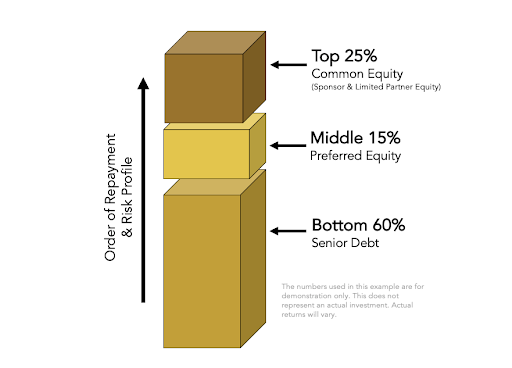

The Fund seeks to identify opportunities where preferred equity can fill the void between common equity and senior debt, allowing investors to realize outsized risk-adjusted returns while limiting downside exposure.

The Federal Reserve interest rate hikes coupled with more restrictive lending parameters from traditional commercial real estate lenders has created a gap in the capital stack for many developers and property owners.

BENEFITS OF PREFERRED EQUITY STRUCTURE

Common equity ahead of preferred equity position creates cushion in the event of value decline.

Preferred equity has priority to common equity for both cash flow and capital events.

Sponsors are required to make current and accrued payments and achieve minimum return requirements.

Remedies may include forced sale, removal rights, control features, and mandatory redemption periods.

Equity kicker is negotiated into most transactions to further boost preferred equity returns.